IPSA publishes MPs' Annual Business Costs for 2021-22

Date published: 17 November 2022

The Independent Parliamentary Standards Authority today published figures for business costs incurred by MPs for their parliamentary duties in the 2021-22 financial year. The data can be found here.

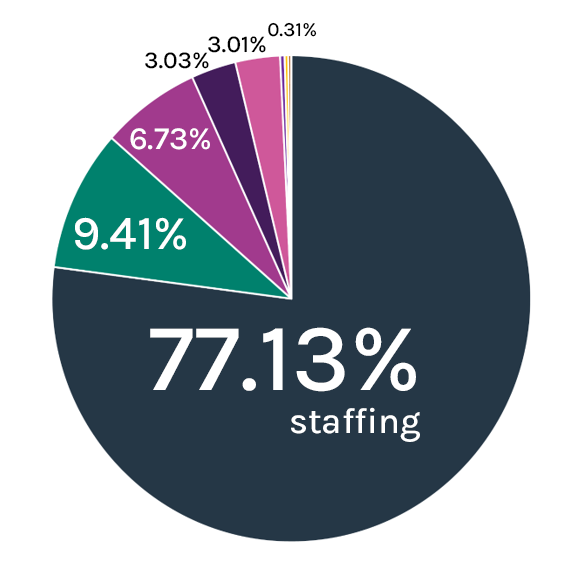

Business costs are the essential costs incurred by MPs while carrying out their parliamentary duties including staffing, office costs and travel. MPs cannot claim for personal costs, such as food and drink, during their normal working day. All claims must be compliant with our rules and accompanied by evidence.

The vast majority – over 77% – of MPs’ business costs are for staff members to help them support their constituents. On average, MPs employ the equivalent of five full-time members of staff to respond to requests from local people, resolve issues and help to represent their needs in Parliament.

IPSA’s Chief Executive Ian Todd, said:

"At IPSA we believe in providing transparency to the public, and for making sure that the information we publish is accessible and meaningful. The data we have published today shows the essential costs incurred by MPs to carry out their parliamentary duties in the year ending March 2022. We know that it has been a challenging year for MPs and they have seen another rise in casework. At IPSA we have supported MPs and their staff to continue to serve constituents, including some of the most vulnerable people in society."

“From setting and monitoring MPs’ budgets to public confidence and MPs’ security, what IPSA does matters and we play our part in a much bigger jigsaw of democracy. The public should be assured that spending on MPs’ business costs is compliant with our rules and helps MPs’ staff around the country to work for their local communities."

We have also published an article on our website to accompany annual publication.

Staffing – £111.2m, up from £105.8m in 2020-21

Office Costs – £13.5m, down from £15.2m in 2020-21

Accommodation – £9.6m, up from £9.3m in 2020-21

Travel & Subsistence – £4.3m, up from £2.1m in 2020-21

Security – £4.4m, up from £4.3m in 2020-21

Other (including staff absences) £442k

Disability – £279k, up from 176K in 2020-21

ENDS

For more details contact IPSA's Press Office: communications@theipsa.org.uk

Follow us on Twitter: @ipsauk

Notes to Editors:

Figures used in the press release above are actual and have not been adjusted. They may be subject to minor revisions.

Spending on MPs’ Security and Disability Assistance are not attributed to individual MPs.

Travel includes travel by MPs, their staff and their dependants.

MPs representing constituencies outside the London Area are entitled to claim for accommodation costs in either London or their constituency, in recognition of the fact that they are required to work permanently from two locations. They can choose between claiming for a rented property, for hotel accommodation, or for associated costs (running costs such as utilities and council tax) on a property they own.

In the 2021-22 financial year, MPs who chose to stay in hotels could claim up to £175 per night to stay in the London Area or up to £150 per night to stay outside of London. Claims for hotel accommodation must be for parliamentary purposes and within the nightly limit, but there was no overall cap on the amount that could be claimed during the year.

For these MPs, IPSA’s published annual data shows the total amount claimed during the financial year. It also shows a notional "budget" amount which is equal to the amount claimed; although in practice, there was no budget cap. This is due to the format used for publication of budget and spend data but should not be taken to mean that an MP has spent right up to the limit of what was available.

From the current 2022-23 financial year, the arrangements for accommodation funding have changed, meaning that MPs have a capped budget for accommodation costs whether they choose to stay in rented accommodation or in hotel accommodation. This provides greater consistency and clarity, and removes the risk of error from budgets being opened and closed when MPs move during the year. When published, the annual data for this financial year will reflect this capped budget for MPs claiming hotel accommodation costs.