Supporting democracy – understanding our 2022/23 data

Date published: 23 November 2023

Transparency is an essential part of supporting trust in democracy. The public has a right to know their money is being spent on the right things, in the right way. Transparency helps provide assurance that public money is being spent wisely.

This is why since IPSA’s creation we have published information about the financial support we provide to MPs in carrying out their constituency and parliamentary duties. This transparency must, however, be meaningful.

There are many myths and misconceptions about MP business costs that threaten to undermine confidence in democracy. As the regulatory body, it is important we explain and contextualise the funds we provide.

We know from the research we have undertaken with the public and stakeholders that there is still a lack of understanding about what MPs need to do to fulfil their public duties, and how that is funded.

This can lead to unfounded criticism of MPs that impacts trust in democracy. And, as highlighted in the recent Speaker’s Conference Report into the Employment of MPs’ Staff, this unfounded criticism also adversely impacts the well-being of MPs’ Staff. We have work to do at IPSA to bolster public understanding of MPs' work and how it is funded.

For example:

MPs don’t decide their own pay or the budget for their own business expenditure. That is the role of IPSA, an independent body.

MP funding is only for costs they incur when performing parliamentary duties. It is not a “bonus” or a “top up” to their salaries.

Most MP funding goes towards paying the staff who work to support local communities on constituency issues.

Claims are only reimbursed if supported by evidence – for example, invoices – and are within the budgets we provide.

Each year we publish the final total spending of all MPs against their budgets in the previous financial year, as well as other information such as MPs' salaries, or staff information.

To view the latest data, visit MPs’ staffing and business costs.

For the first year, we have also produced a guide to understanding what business costs are, with a specific focus on staff costs.

For more information, visit Supporting democracy – funding of MP parliamentary duties 2022/23.

Business costs

These are claims made by MPs to cover the business costs they incur while carrying out their parliamentary and constituency duties. The payments are for goods or services supplied to MPs. All claims must be compliant with our rules and accompanied by evidence. Business costs are not part of an MP’s pay.

For more information visit our Guide to MPs’ claims.

Staffing

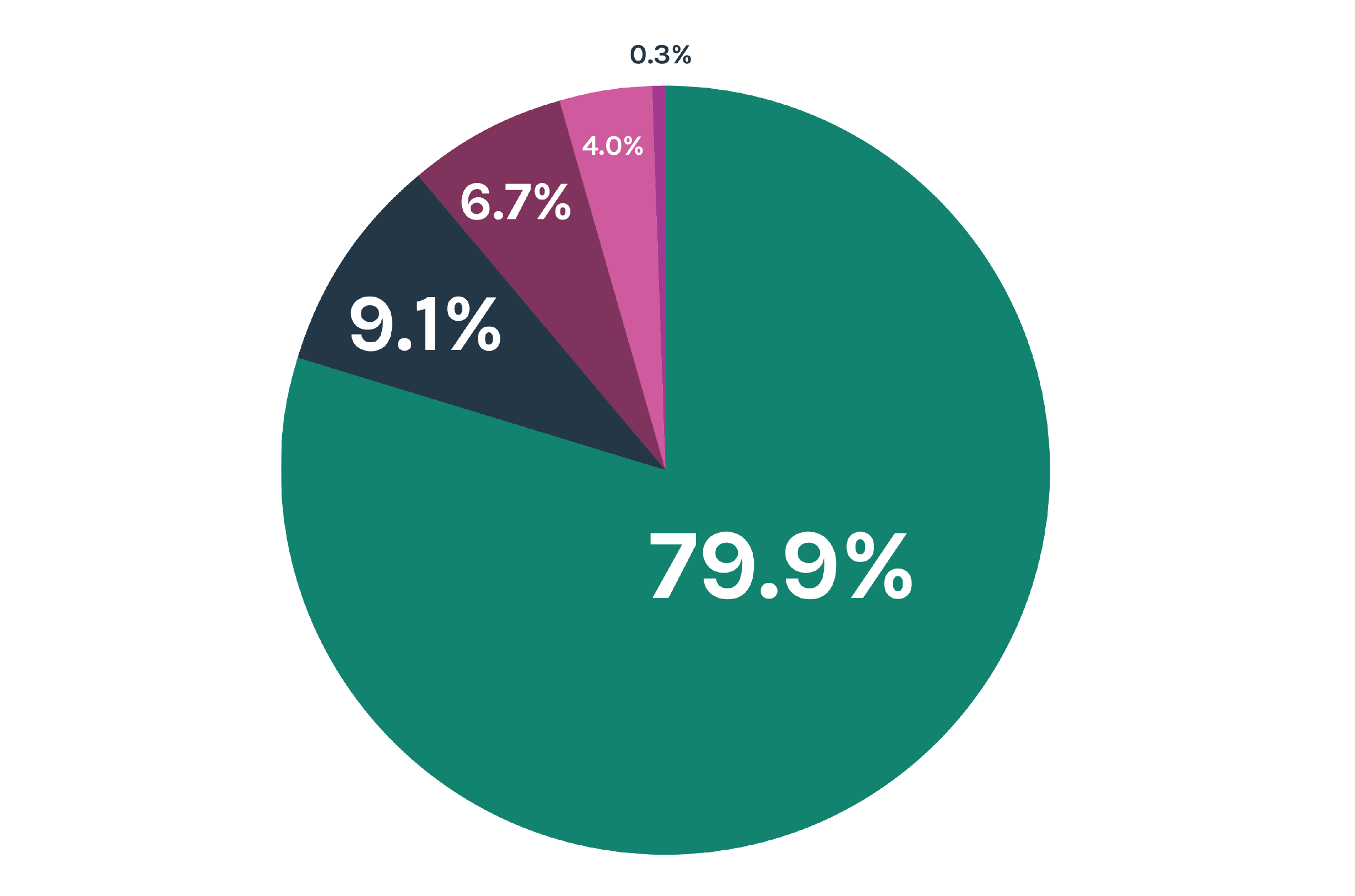

The vast majority of MPs’ expenditure – almost 80% in 2022-23 – is for employing staff to support constituents and other parliamentary duties.

The staffing budget per MP for this year was £221,750 (for an MP with a constituency outside London) and £237,430 (for an MP with a London constituency).

Typically MPs employ around five full-time equivalent members of staff to help respond to requests from local people, resolve issues and represent their needs in Parliament.

Running a constituency office is like running a small business – costs are incurred for renting, heating, and lighting an office, providing services, and managing staff.

It is often an unseen part of an MP’s role but requires good office management to ensure constituents receive the appropriate support they need.

Dealing with casework

The range of casework MPs deal with on behalf of their constituents is wide and varied. It includes assisting with housing or social welfare issues, immigration matters, healthcare, education, and any other issues constituents seek help with.

Casework involves liaising with relevant government departments, local authorities, or other organisations to resolve problems and advocate for constituents.

| Budget type | Spend amount | Overall % |

| Staffing | £121.52m | 79.9% |

| Office | £13.89m | 9.1% |

| Accommodation | £10.20m | 6.7% |

| Travel and subsistence | £6.06m | 4.0% |

| Other | £0.38m | 0.3% |

Staffing expenditure

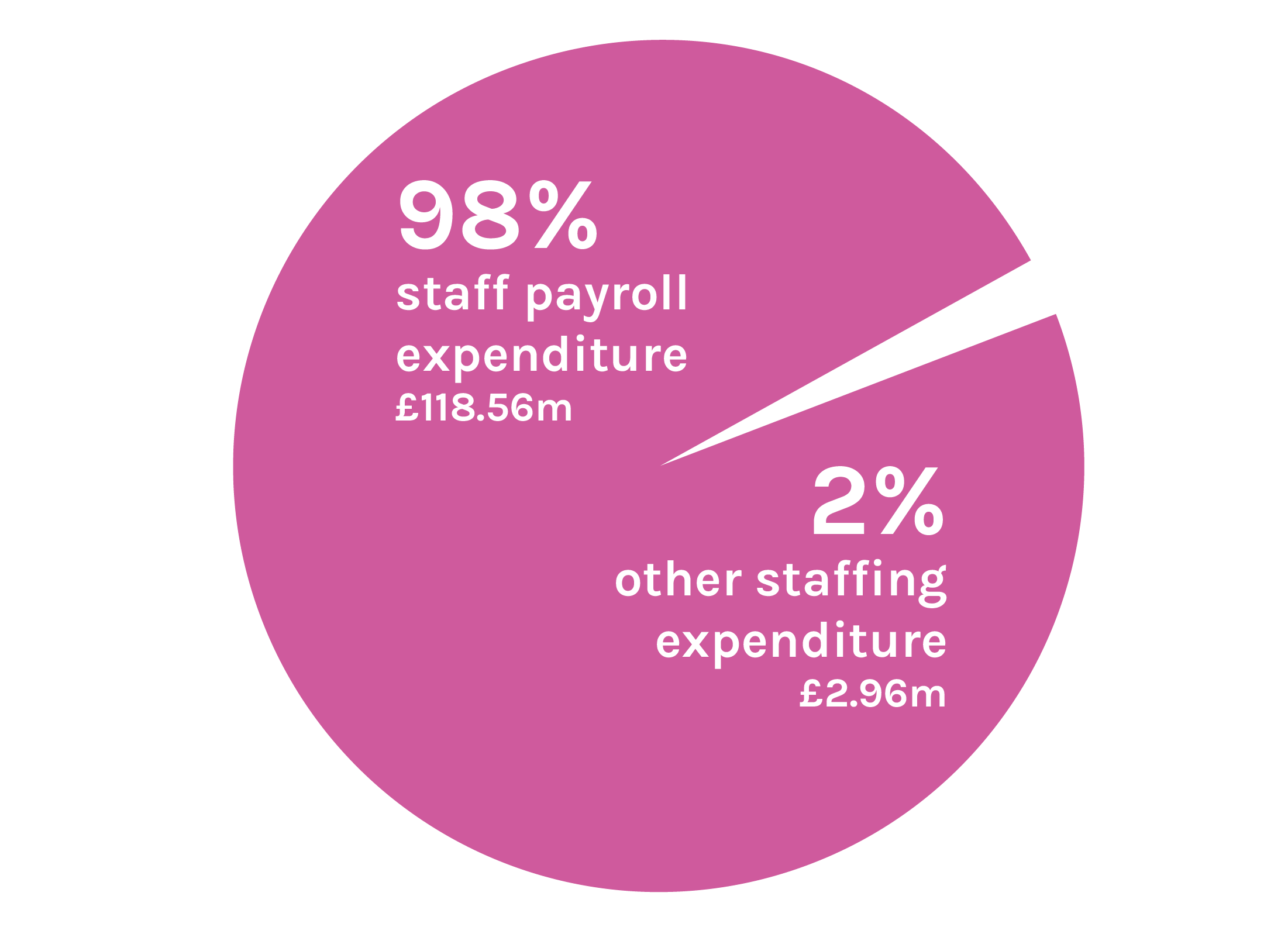

Almost all staffing expenditure pays for staff salaries. In 2022/23, 98% of staffing expenditure paid for:

basic salary

Employer’s National Insurance

pensions

overtime

childcare vouchers

No personal costs

MPs are not allowed to claim for personal costs.

They can’t claim the cost of food and drink in their normal working day, although they can claim a modest amount of subsistence of £25 per day if they are away from London or their constituency for parliamentary purposes.

This is similar to what happens in other jobs where you are required to travel on business.

MPs can’t claim for their daily commute to work at either their constituency office or the Houses of Parliament.

For those MPs with constituencies beyond London, they can claim the costs of travel to London to represent their constituents. MPs can claim the cost of other journeys for parliamentary purposes.

They also can’t claim the cost of a second home. Non-London MPs can only claim for hotels, rented accommodation or associated costs in either London or their constituency while they fully fund their accommodation in the other location.

Compliance with IPSA rules

Since the 2009 expenses scandal, we have provided robust regulation and transparent rules to make sure claims are legitimate.

Almost 600 of the current 650 MPs joined Parliament in the years since 2009, and the IPSA system is all they have ever known.

Although the total amount of MPs' staffing and business costs may appear to be high – higher than many of us spend in a year – on average each MP represents around 70,000 people in their constituencies and often works between two locations.

Our data tells us that claims made by MPs are 99.89% compliant with our rules and that the small proportion of non-compliance is often the result of mistakes or misunderstandings.

How to review the data

To understand how your MP has spent the money available to them, you need to take into account the circumstances of their office and the constituency they represent. This makes it difficult to compare one MP against another.

If your MP has a constituency office, you should consider how expensive it is to rent an office in your area and examine how the Office Costs budget has been used to support their constituents.

For the Travel budget, consider how far your constituency is from Westminster, and how many journeys could be made locally by your MP to meet constituents or further afield to support their parliamentary work.

With the Accommodation budget, think about the number of nights your MP spent away from home in a hotel or rented accommodation while needing to work from two locations.

Our role

IPSA is dedicated to independently setting, administering, and regulating MPs’ business costs, and supporting the good functioning of MPs’ offices to help them provide services to your constituency.

Given the unique circumstances of their roles and the safeguards we have in place, the best way to assess the value of your MP is to focus on the impact they have within your constituency and the service they provide to the people they represent.